Your dollars are designed to lose value. Here’s why:

Dollars are fiat currency.

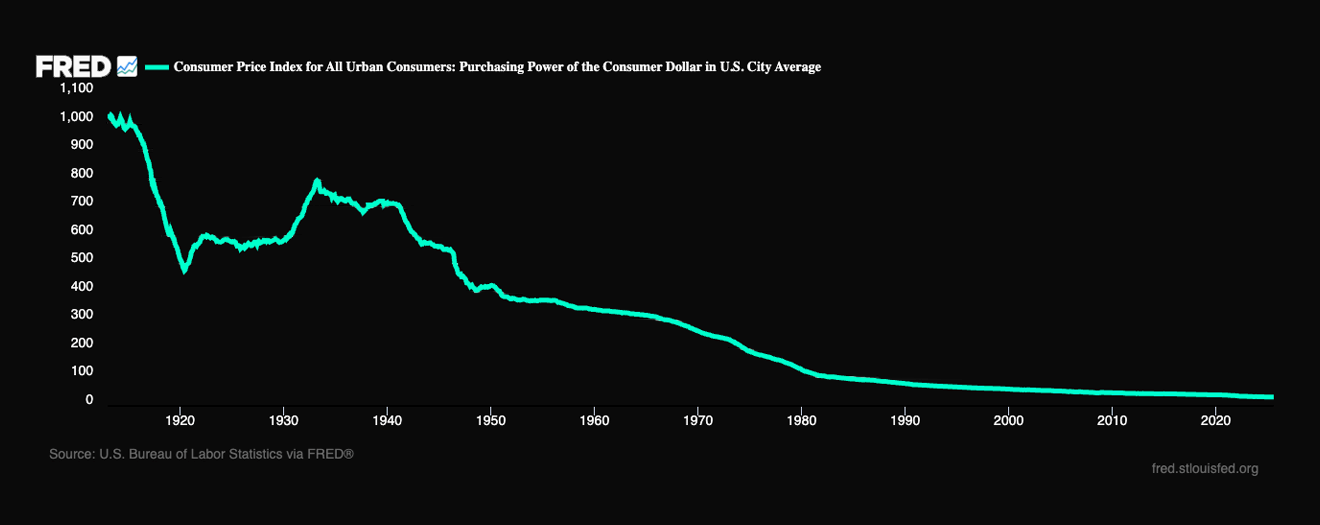

Most modern currencies today are fiat, including the US dollar. Fiat currencies get their value from the faith and fear of a government, and more of the currency can be created at will. Creating more of the currency reduces its scarcity, helping to drive its debasement, or loss of value over time.

Inflation erodes dollar value.

Increasing the supply of fiat currency means there’s more currency competing for the same goods and services, resulting in the natural market forces of rising prices. This inflation on the price of goods means your money no longer buys as much, or loss of its purchasing power.

The system ensures the result.

Governments around the world use monetary policy tools to try and maintain the inflation of their currency to about 2% a year. If it’s too high, they work to lower it. If it’s too low, they work to raise it.

If you’ve heard someone older than you reminiscing about the comically cheap prices of goods in the past, that’s the result of generational debasement and inflation. This is also why the common wisdom is to move dollars into harder or appreciating assets, like real estate, the stock market, precious metals, and Bitcoin.

This is sound money. It’s designed to preserve value.

Instead of being made out of paper, we made cash out of gold. Throughout human history, gold has largely been the preferred sound money instrument. Today, gold is one of the largest asset classes in the world.

The supply of gold rises slowly because it has to be mined out of the ground. It isn’t easily created from nothing, like fiat currency. Although it is a metal, it does not rust or corrode. It has practical utility in technology. It’s universally valued today, and has been by humans for thousands of years. Gold is the quintessential sound money instrument.

Gold acts as a hedge against inflation, or a way to store economic value that resists the predictable debasement of fiat currencies. Because the purchasing power of fiat reliably decreases over time, the market price of hedges like gold tend to go up. The price of gold, as measured in dollars, is subject to the same constant inflationary pressures.

Introducing

The Sound Money Standard.

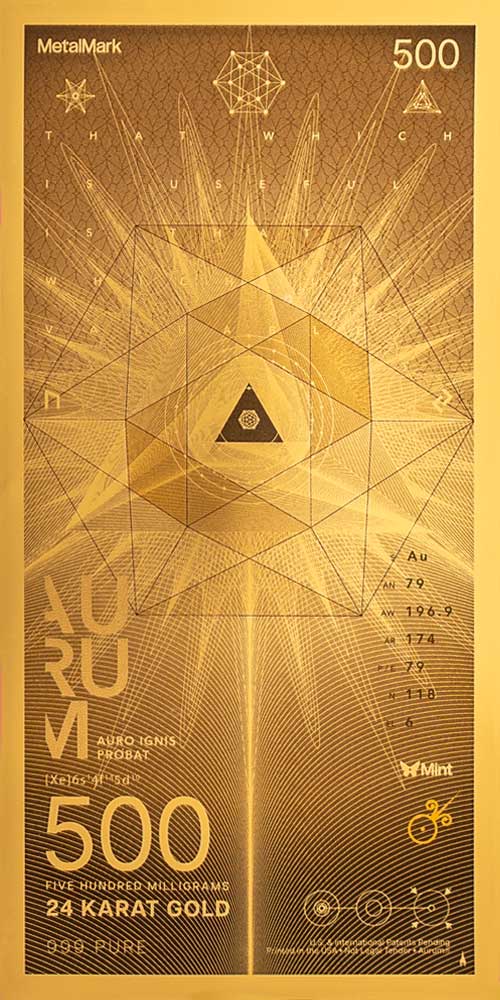

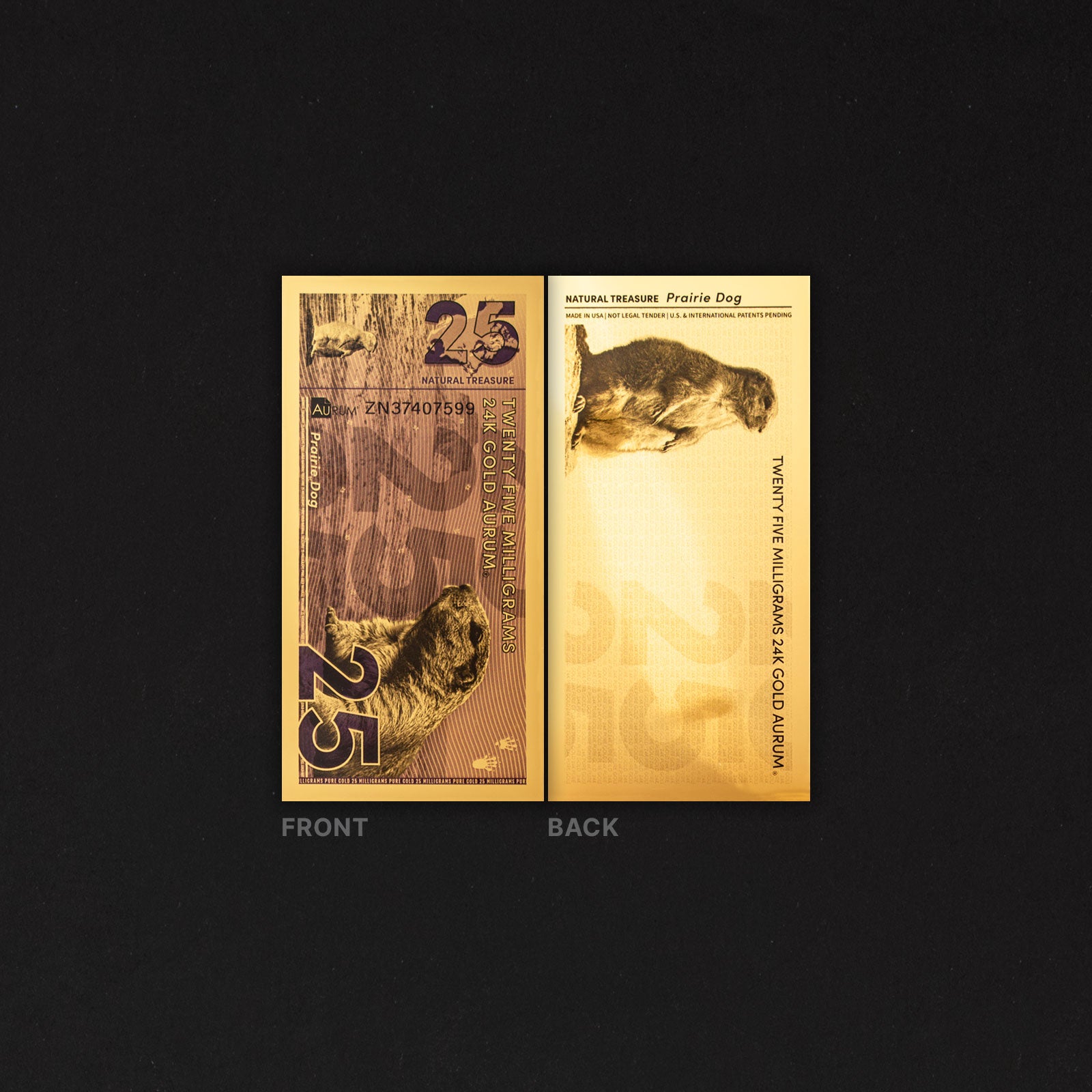

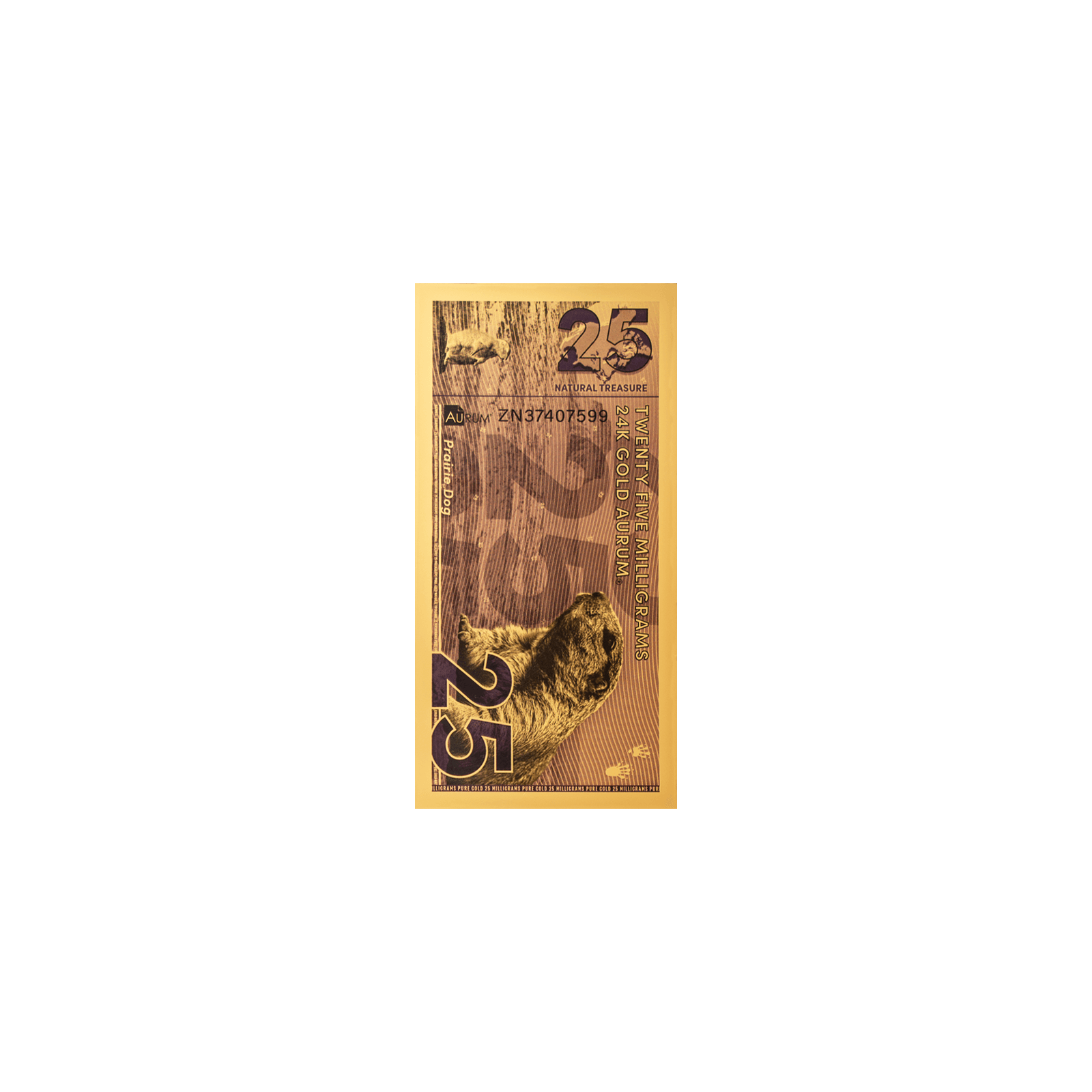

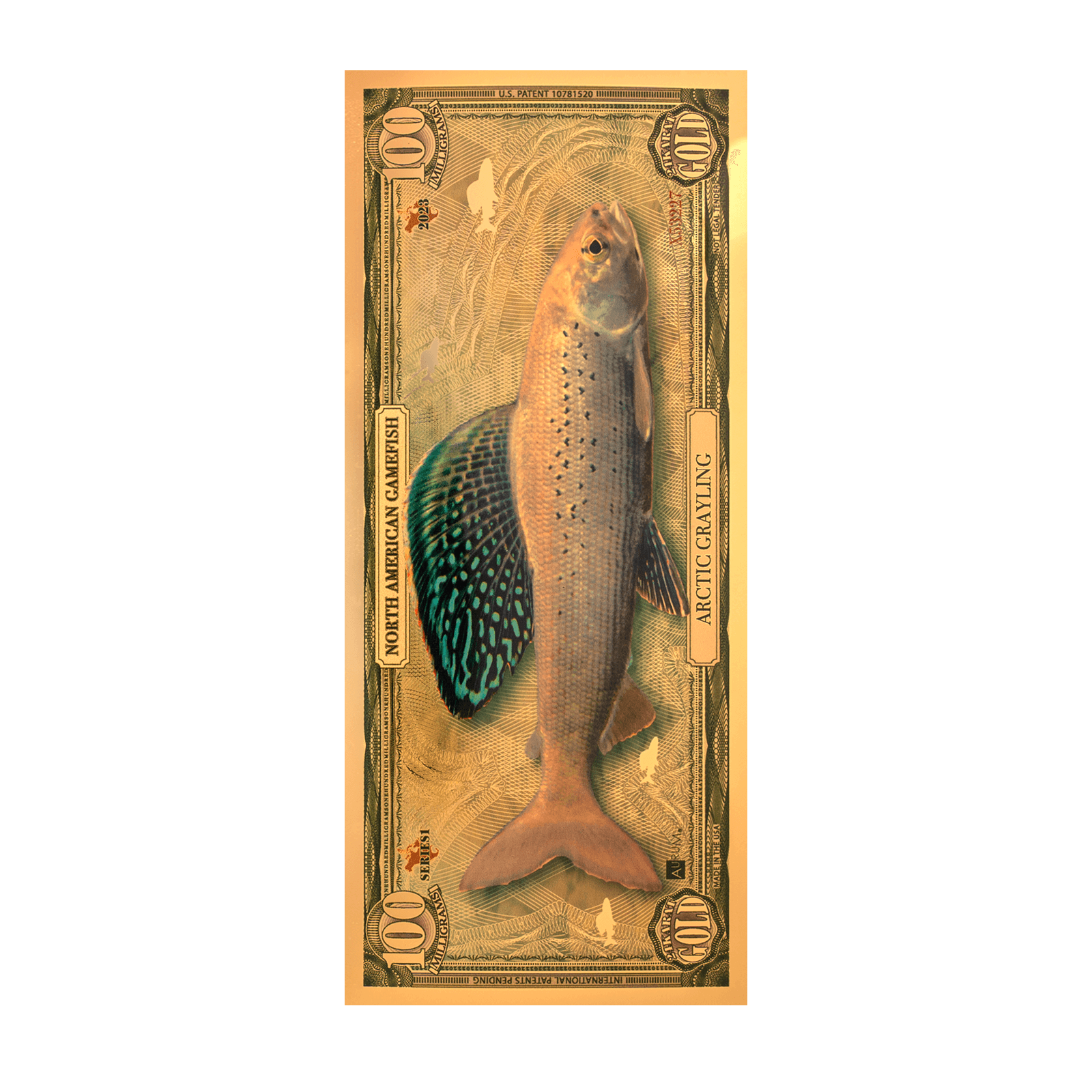

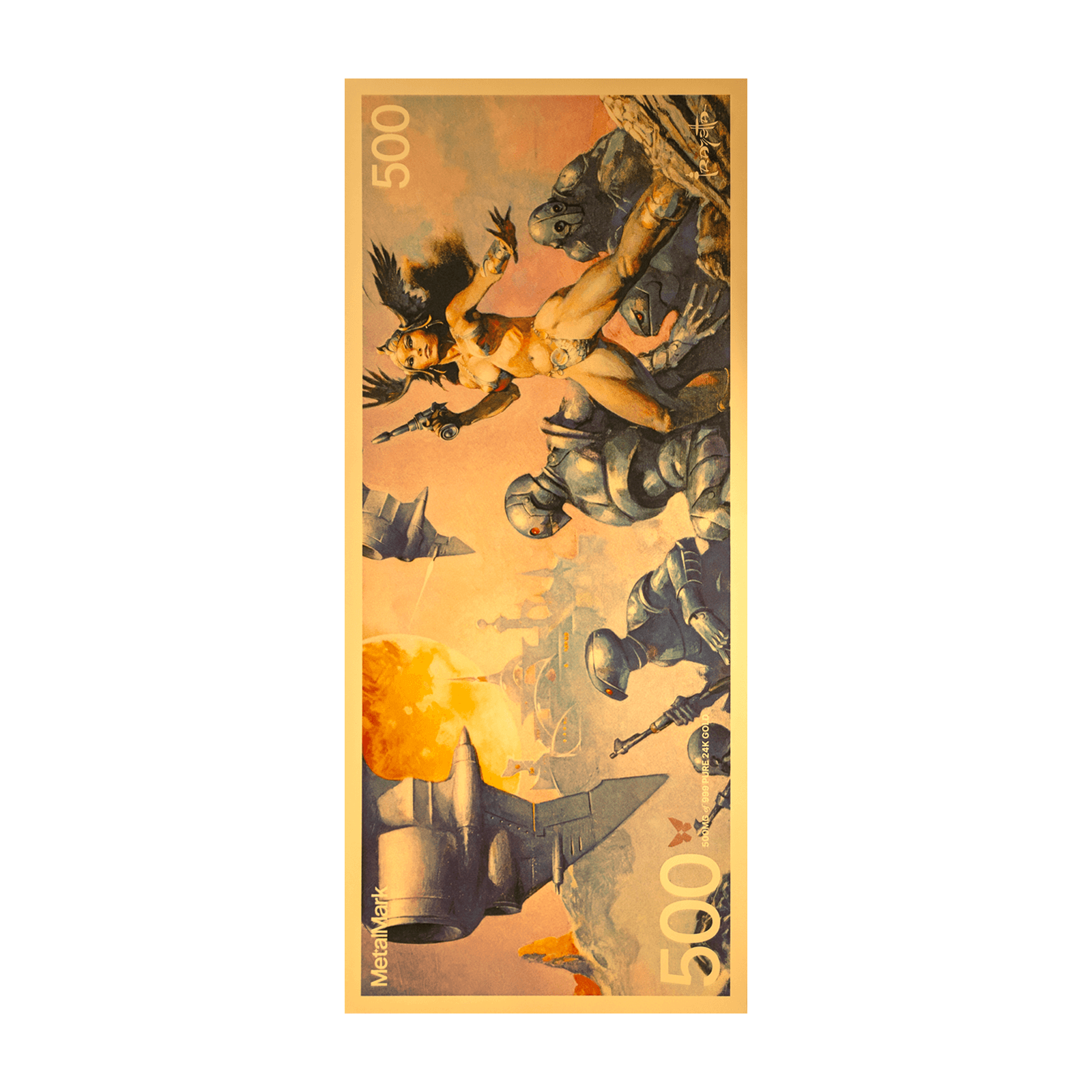

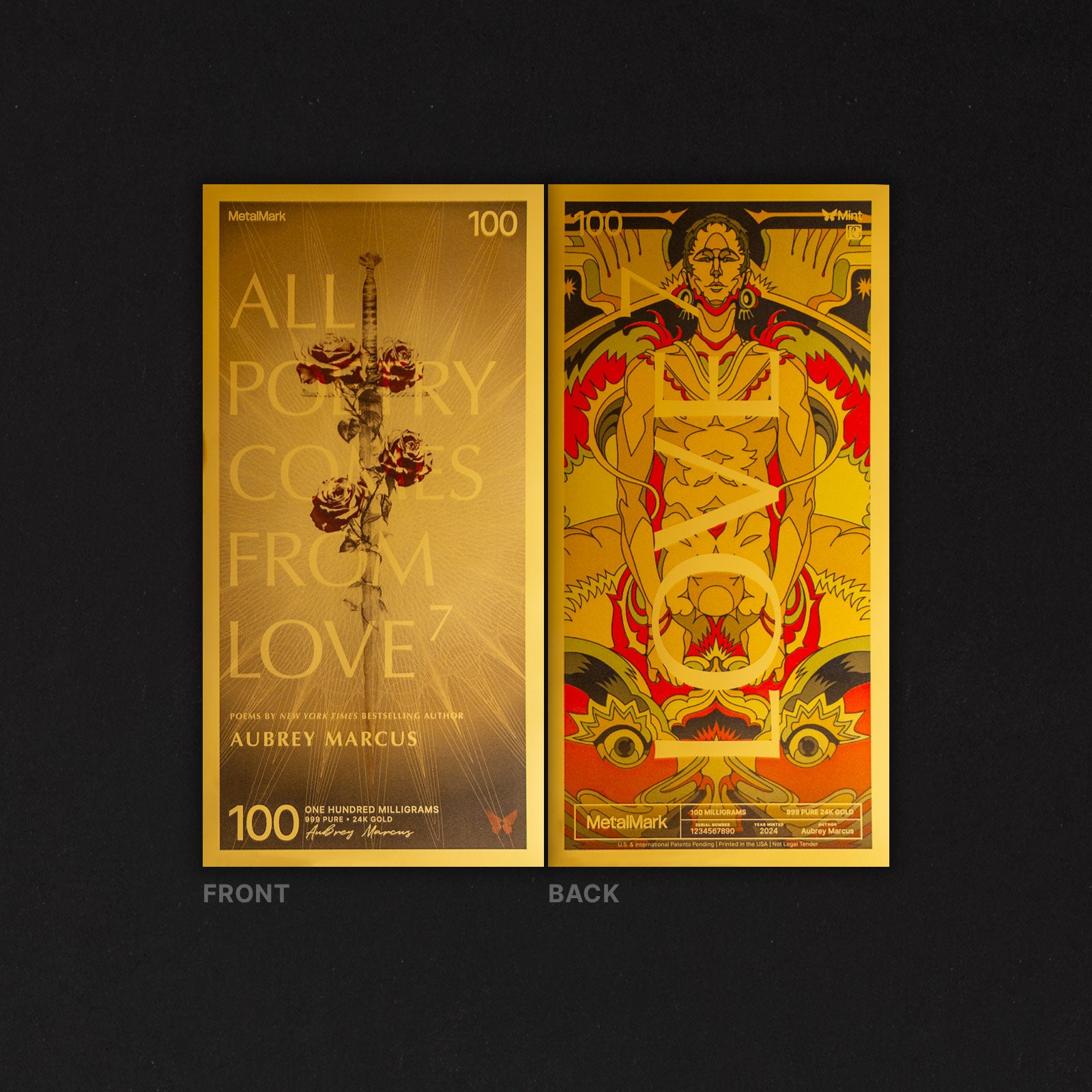

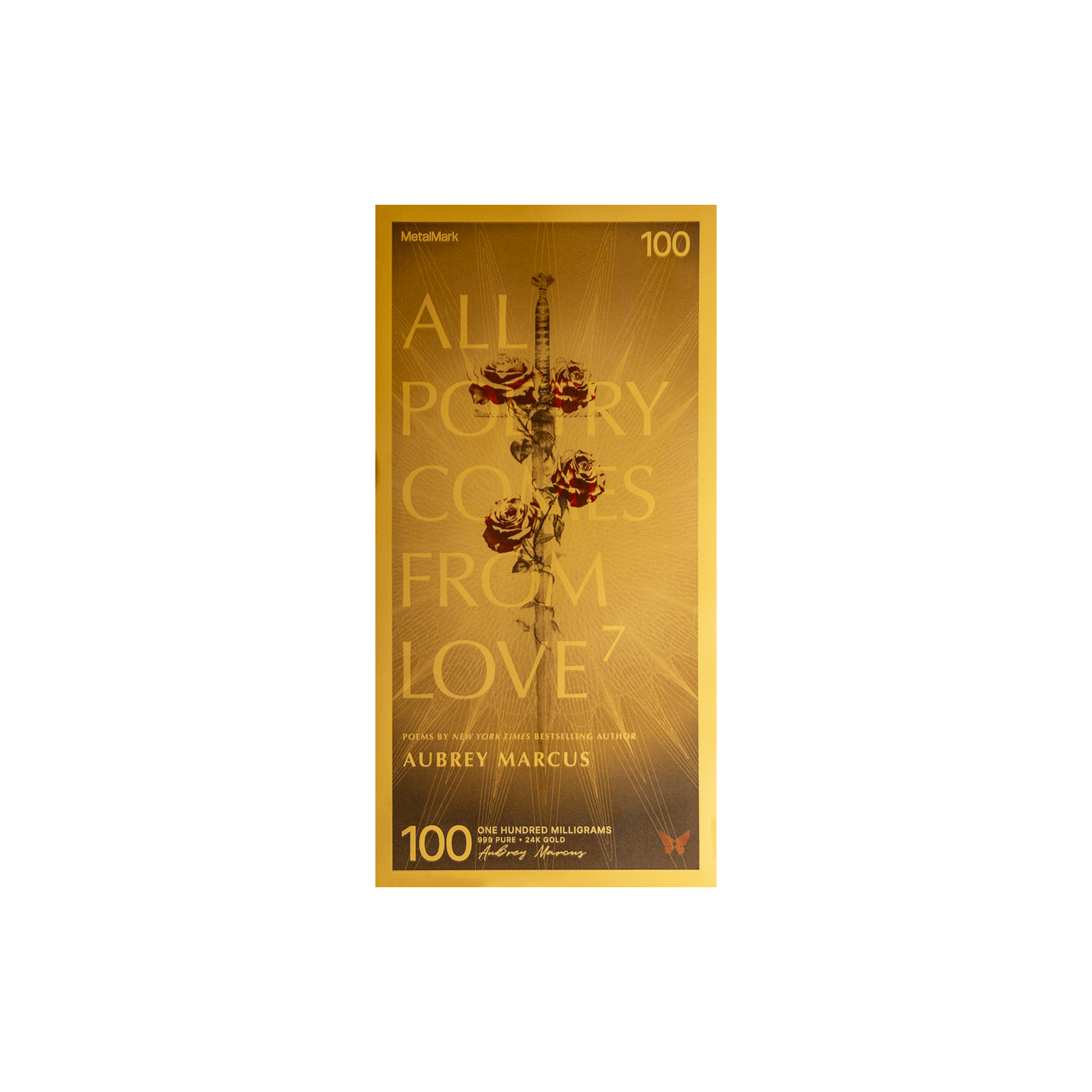

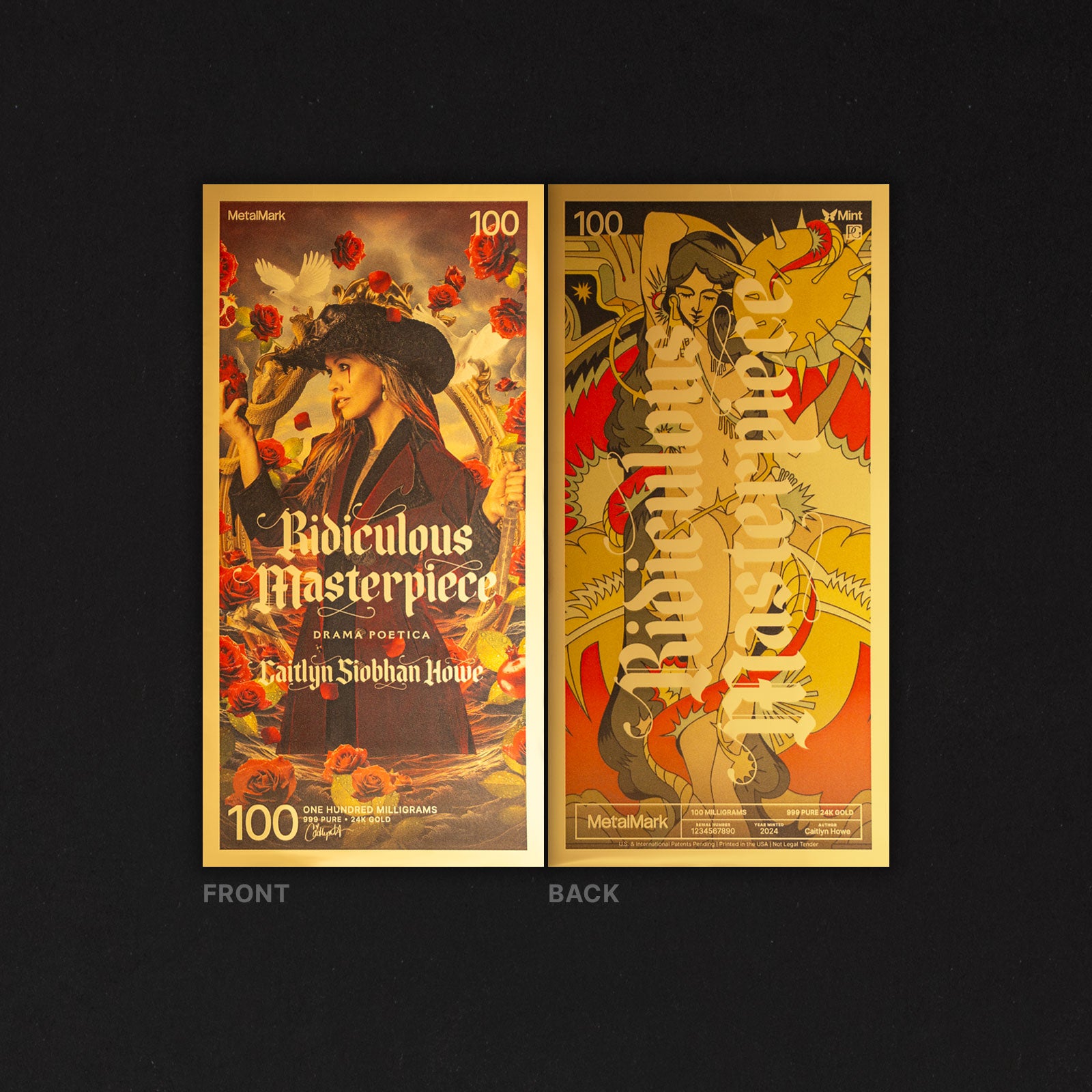

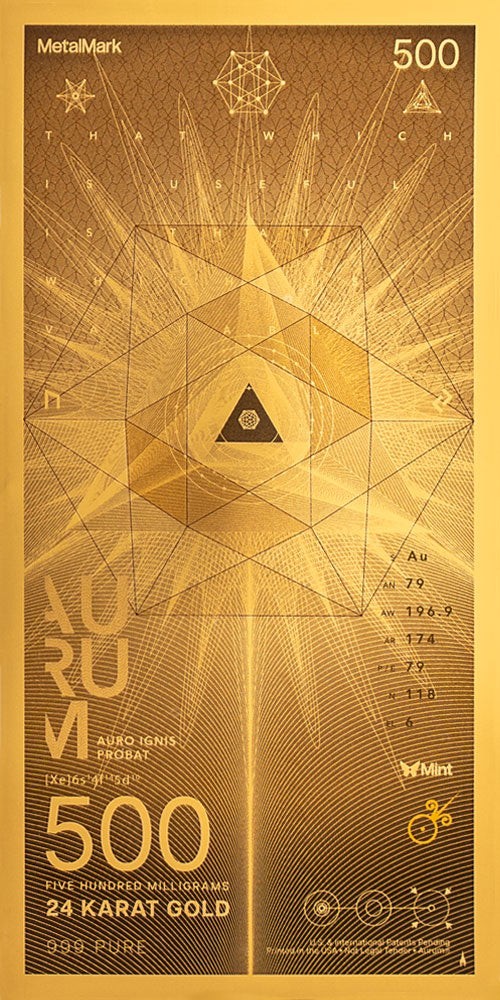

Our Standard bills are physical gold cash that have varying amounts of real 24-karat gold. Instead of being denominated in dollars, each bill shows how many milligrams of gold it contains. This can then be used as a medium of exchange with participating sellers in the routine exchange of goods & services, just like normal cash.

Standard weights

Standard Aurums are denominated in the metric system, allowing for simple full-integer face values and no fractions. Given the meteoric rise in gold’s spot price, increasingly more institutions are defaulting to measuring it in grams instead of ounces.

Standard sizes

Standard Aurums have what’s known as “stepped sizing,” which means we have a unique physical size for every denomination. This helps the vision impaired to navigate denominations, and it helps standardize an ecosystem of accessories.

Standard pricing

MetalMark Standard bills are pegged to the spot price of gold. For better or worse, the price of our bills reflects the spot price of gold. We update pricing multiple times a day and do not have stop limits or other measures controlling the price.

Standard security

Using incredibly sophisticated technology adapted from both the semiconductor industry and central bank currency printers, the patented process imparts the same modern anti-counterfeiting measures found in the most secure modern currencies.

Standard API

Each Standard Aurum is individually serialized, and we offer a JSON REST API for developers who want to integrate Standard functionality into their applications. This API will expand with more features as we grow, including seamless integrations with common POS systems.

An open Standard

Aurums are a modern marvel of engineering, and they represent the best form of sound money cash today. Our Standard is open source, meaning anyone wanting to create their own Standard Aurums are welcome to adopt the Standard and improve the network.

Secure by design.

Our mint developed proprietary technology adapted from currency printers and the semiconductor industry. It’s the only one in the world capable of making these bills, and it uses the same anti-counterfeiting measures that protect modern currencies.

Most banknotes or collectibles have one serial number to verify it as authentic. In an industry first, we use dual-factor serialization: the bill itself and a FIPS-compliant Certificate of Authenticity.

Both unique serials can be quickly checked together to determine if the bill is genuine, just like a username and password.

Developed by the National Institute of Standards and Technology (NIST) for the US Government, the Federal Information Processing Standards (FIPS) set a high bar for document security.

Explore details

A bold denomination that shows how much 999 pure 24-karat gold is in the bill, measured in milligrams.

Massively intricate golden linework, guillochés, and other trade secret design elements create nigh insurmountable hurdles for bad actors.

Indica designed to evoke curiosity and convey deeper meaning in the art. The closer you look, the more you'll see.

A bold denomination that shows how much 999 pure 24-karat gold is in the bill, measured in milligrams.

Massively intricate golden linework, guillochés, and other trade secret design elements create nigh insurmountable hurdles for bad actors.

Indica designed to evoke curiosity and convey deeper meaning in the art. The closer you look, the more you'll see.

Aurum® In Stock & Ready to Ship

FAQ

These aren’t NFTs or just JPGs on the internet. We make real, physical art printed with 999 pure 24-karat gold at a caliber shared by authentic government bank notes.

We ship these straight to your door, no digital wallet required.

In short, yes. Gold has historically been money for basically all of human history.

But there’s nuance with modern governments. Despite sharing a similar form factor, boldly designed denominations, and intricate security features, MetalMark assets are not federally-recognized legal tender. The US government officially only recognizes its own fiat currency it created — the dollar — as legal tender, with some gold coins also recognized.

But being federal legal tender just means that’s what the government accepts for paying taxes and other debts. It has no bearing on what you do privately.

Our gold cash has trading, market, and intrinsic value tied to the underlying commodity it contains. There is no federal law preventing any citizen from voluntarily conducting transactions in gold. Or bagels, for that matter.

Two MetalMark Standard bills are available today, with the full system due to be launched in Q2 2026.

The flexible polymer protecting our bills has been engineered to last virtually indefinitely, and won’t yellow or crack with time.

The gold in each bill is naturally resistant to oxidation, and, coupled with the polymer, will never rust, tarnish, or discolor. You can expect each to remain like new even after years of storage or exposure to air.

This is a growing community, and you can use the bills to buy and sell things between other people in the community.

The larger we make the community together, the more utility and opportunity gold will have as a medium of exchange.

In a word, inflation. The prices of things goes up over time, making the dollars in your pocket worth less over time. Stuff used to be $5 and now it’s $10. This has been the case for our grandparents & parents, it is the case for us, and it may also be the case for our children. It is the current economic reality of fiat currency.

Gold gets priced in fiat currency, and the price of gold generally goes up over time as a result. If you have gold in your pocket, then historically over time, that gold has minimally preserved its value, if not outright increasing its value.

You’d want gold in your pocket instead of paper, because historically, gold goes up and dollars go down.

Metalmark is a family of butterflies, so named due to the metallic markings found on their wings. We find inspiration not only in the surface beauty of these butterflies, but more deeply in their transformative journey to achieve that beauty.

With MetalMark, we’re making beautiful, intrinsically valuable assets to help transform the functional nature of money, as well as expand what fractional gold can be.

Space is limited, but we’re always on the lookout for amazing artists and brands to help push the boundaries of what fractional gold can be. Drop us a line at partner@mtlmrk.com.

Beyond the Bar

Dive into more content.

Going to the Moon Gone Wrong: Zimbabwe’s Hyperinflation Nightmare

In the late 2000s, Zimbabwe experienced spiraling hyperinflation, leading to the printing of the now infamous 100-trillion-dollar banknotes that were nearly worthless. This economic nightmare, driven by a collapse in production and rampant money printing, serves as a stark reminder of the fragility of fiat currency and the devastating human cost of failed monetary policy.

Read more

Gold Spot Price: Everything You May Not Know

Why are Aurums sold over the spot price of gold? What is the spot price of gold anyway, and should all gold products cost the same as their melt value? Wait, what’s a melt value? Let’s dive in.

Read more